Talks of an improving trade situation and a lower likelihood of a government shutdown has stocks rallying on Tuesday, with many names making notable moves. Let’s look at a few must-see stock charts for Wednesday.

Note: We’re seeing big upside reversals in Shopify (NASDAQ:SHOP) and Under Armour (NYSE:UAA). While they are big movers on the day, I don’t want to cover them here again, with yesterday’s earnings previews proving that the levels are accurate.

Must-See Stock Charts #1: Gilead Sciences

After Gilead Sciences (NASDAQ:GILD) reported earnings earlier this month, I said bulls could justify a position above the 50-day moving average or $67. However, should this level fail, a drop down to $63 is possible, I reasoned.

Disappointing data on Tuesday almost knocked the stock down to that level, before shares recovered. Now GILD is sort of in no man’s land down here. While bulls can technically stay with this one, there are better plays out there right now, as you’ll see in a moment. It might be time to find a new trading vehicle for all you non-investors in Gilead.

Compare Brokers

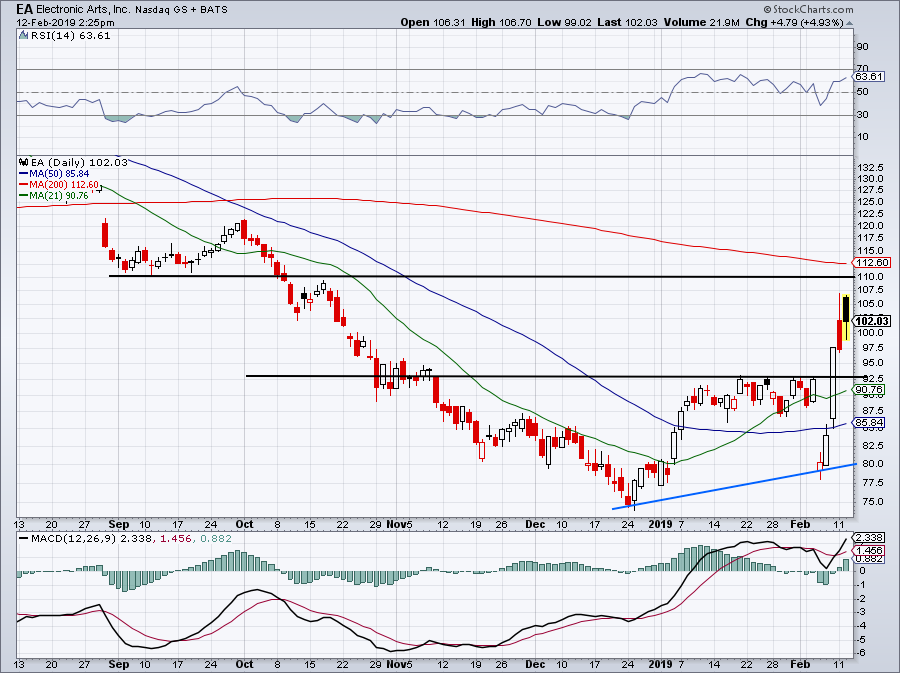

Must-See Stock Charts #2: Electronic Arts

Man, if you want casino vibes just check out Electronic Arts (NASDAQ:EA). This thing is up, down and then up again all in a session or two. Seems like $110 to $112 is a reasonable upside target and if long, I wouldn’t want to see EA below $92.50.

Don’t forget, Activision Blizzard (NASDAQ:ATVI) reports earnings (we outlined that one too with SHOP and UAA) and it will likely have some sort of impact on EA on Wednesday.

Compare Brokers

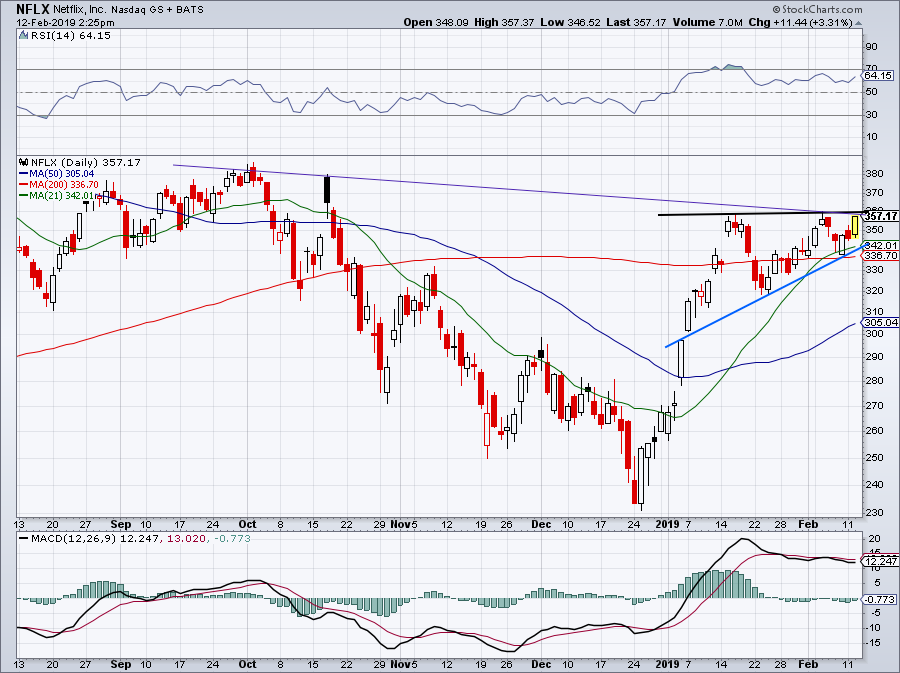

Must-See Stock Charts #3: Netflix

As long as we don’t get a huge pullback in the markets, Netflix (NASDAQ:NFLX) seems to be setting up for a big-time breakout. Over this ~$360 level and NFLX could quickly spark a $20+ rally. However, below the 21-day and this one’s fizzling out.

Short and sweet? Yep, but the best setups are.

Compare Brokers

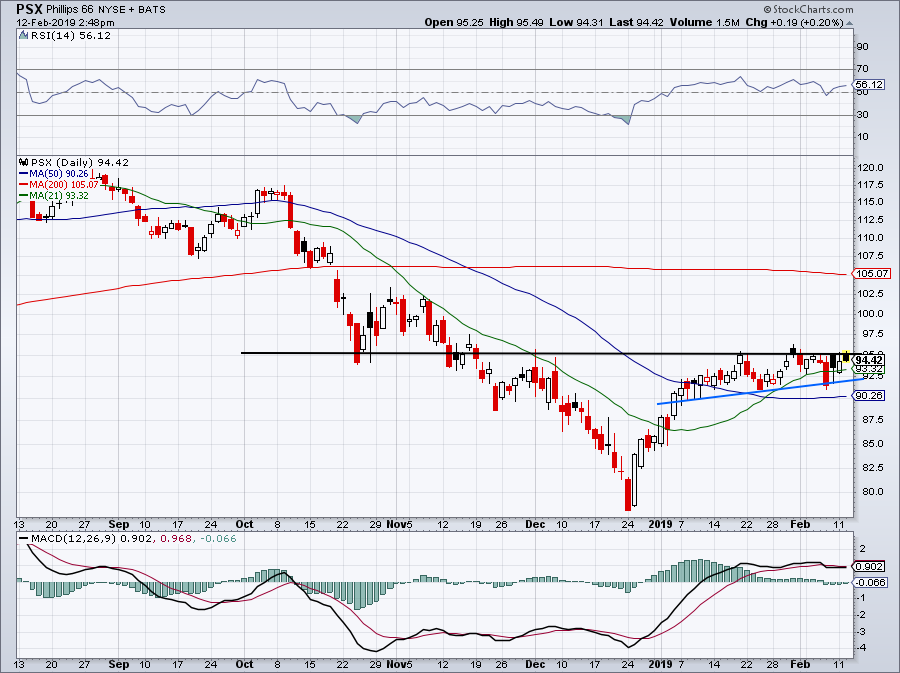

Must-See Stock Charts #4: Phillips 66

Knock, knock, knockin’ on $95’s door is Phillips 66 (NYSE:PSX), which is threatening to burst higher once this mark gives way. If it does, I’d love to see $95 become support going forward. On the upside, investors can target $102.50 to $105.

Below uptrend support (blue line) and this one is officially cracking, but below the 50-day and the breakout is officially off the table for the time being.

Compare Brokers

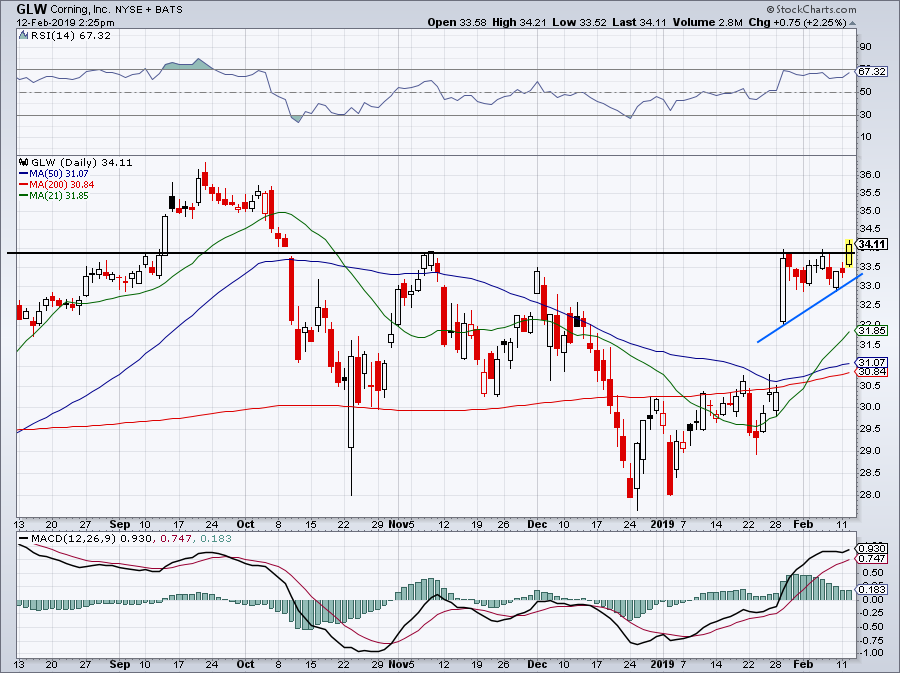

Must-See Stock Charts #5: Corning

We could have seen a better close in Corning (NYSE:GLW) on Tuesday, as it threatens to breakout higher. Keep in mind GLW is already up big from last month’s strong earnings result. With that said though, it’s handling a big level at $34 impressively. I want to see some continuation this week to fuel this one higher. Over $35 and this one might see new 52-week highs.

Below uptrend support and $33, and we’ll need to see it reset before going long again.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforemen

No comments:

Post a Comment