Illinois lawmakers approved reducing annual cost-of-living increases for retirees, raised the retirement age for younger workers, and imposed a limit on pensions for the highest-paid workers.

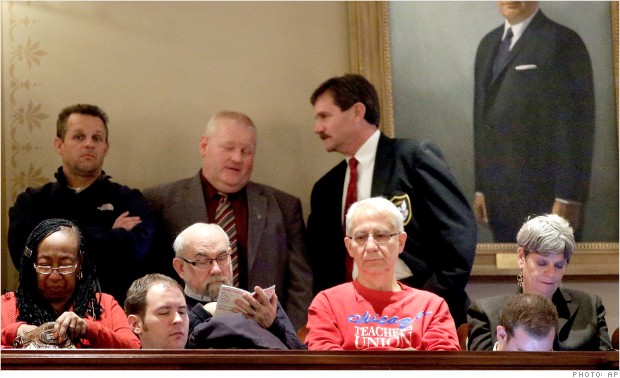

NEW YORK (CNNMoney) Illinois lawmakers approved a landmark pension reform package Tuesday that would cut retirement benefits for teachers, nurses and other retired and current state workers.The legislation comes after years of debate on how to fix the state's ailing retirement system -- considered the most troubled in the country.

Ultimate Guide to Retirement Getting started401(k)s & company plansInvestingAnnuitiesIRAsSelf-employment plansPensions and benefit plansSocial SecurityInsuranceEstate planningLiving in retirementGetting helpThe plan will reduce annual cost-of-living increases for retirees, raise the retirement age for workers 45 and under, and impose a limit on pensions for the highest-paid workers.

Employees will contribute 1% less out of their paychecks under the reform, while some will be given the option to contribute to a 401(k)-style plan.

Legislative leaders of both parties crafted the deal, which they say will save $160 billion over the next three decades -- savings desperately needed to help fill the state's $100 billion pension shortfall.

The bill will head to the desk of Governor Pat Quinn, who is expected to sign it into law. He said Tuesday the plan "addresses the most difficult fiscal issue Illinois has ever confronted."

Illinois unions, who have announced strong opposition to the deal, are expected to challenge it in court.

"Teachers, caregivers, police, and others stand to lose huge portions of their life savings," We Are One Illinois, a coalition of labor unions, said in a statement.

On the flip side, some argued that the reform doesn't go far enough.

Illinois, which has the worst credit rating of any state in the country, has set aside only 40% of the funds it needs to pay the pensions it promised current workers and retirees. Today, 20 cents of every tax dollar goes toward pension obligations -- up 400% from two decades ago, according to a recent report from the Pew Charitable Trusts.

Many cities and states across the country are struggling to keep up with pension bills. But most major pension reform in recent years has focused on cuts to new hires, not current workers and retirees.

Retired union workers facing 'unprecedented' pension cuts

In Illinois, one of the plan's biggest changes will significantly slow the growth of retirees' pension checks. Currently retirees receive 3% annual increases. So an initial $30,000 pension benefit would become $30,900 the next year, nearly $40,000 after 10 years, mo! re than $50,000 after 20 years and so on.

Under the deal, the annual bumps will now only apply to a portion of pension payouts, based on a formula using years worked. For example, a retired teacher with 25 years on the job would receive 3% increases on only the first $25,000 of pension benefits, a base amount which would be tied to inflation.

Detroit tries to rise again

Detroit tries to rise again Proponents say the reduced increases will help keep pensions in check, especially for higher-paid workers.

Unions counter that the cuts will significantly erode pension benefits over time and make it "impossible" for retirees to keep up with inflation. Many government workers are not eligible for Social Security and so rely heavily on their pensions.

A state nurse who retired with a $40,000 pension would lose more than $7,500 in the next five years, according to We Are One Illinois, while younger workers could see deeper reductions. ![]()

No comments:

Post a Comment