One of the benefits of attending the Berkshire Hathaway (NYSE: BRK-B ) shareholders' meeting is learning from the great value investors and Buffettologists who also make the yearly trek to Omaha. In this multipart series, Fool analyst Rex Moore speaks with Lawrence Cunningham, author of The Essays of Warren Buffett: Lessons for Corporate America. The book offers a unique approach by arranging all of Buffett's shareholder letters thematically, rather than chronologically.

Today, Professor Cunningham explains which themes have remained constant in these letters throughout the years.

What about the stock?

Thanks to the savvy of investing legend Warren Buffett, Berkshire Hathaway's book value per share has grown a mind-blowing 586,817% over the past 48 years. But with Buffett aging and Berkshire rapidly evolving, is this insurance conglomerate still a buy today? In The Motley Fool's premium report on the company, Berkshire expert Joe Magyer provides investors with key reasons to buy as well as important risks to watch out for. Click here now for instant access to Joe's take on Berkshire!

Top Warren Buffett Stocks To Own Right Now: Opko Health Inc(OPK)

OPKO Health, Inc., a pharmaceutical and diagnostics company, engages in the discovery, development, and commercialization of novel and proprietary technologies primarily in the United States, Chile, and Mexico. It provides a range of solutions, including molecular diagnostics tests, proprietary pharmaceuticals, and vaccines to diagnose, treat, and prevent neurological disorders, infectious diseases, oncology, and ophthalmologic diseases. The company offers molecular diagnostic platform technology for the rapid identification of molecules or immunobiomarkers; Alzheimer?s test for Alzheimer?s diagnostic; and protein-based influenza vaccines to provide multi-season and multi-strain protection against various influenza virus strains, such as seasonal influenza strains, as well as global influenza pandemic strains which include swine flu, and avian flu. It also offers Oligonucleotide Therapeutics for the treatment of various illnesses, including cancer, heart disease, metabolic disorders, and genetic anomalies; and oligosaccharide for asthma and chronic obstructive pulmonary diseases. In addition, the company provides Rolapitant, a potent and antagonist; neurokinin-1, which has completed Phase II clinical trials for prevention of chemotherapy induced nausea and vomiting, and post-operative induced nausea and vomiting; and SCH 900978 that has completed Phase II clinical trials for chronic cough. Further, it offers bevasiranib, a drug candidate for the treatment of Wet AMD; and develops Aquashunt, a shunt to be used in the treatment of glaucoma. Additionally, the company involves in the development, commercialization, and sale of ophthalmic diagnostic and imaging systems, and instrumentation products. OPKO Health, Inc. was founded in 2006 and is headquartered in Miami, Florida.

Advisors' Opinion: - [By John Udovich] SafeStitch Medical Inc. A developer and marketer of�best in class disposable medical devices to advance minimally invasive surgery for hernia repair, treatment of obesity and other gastroesophageal disorders, small cap SafeStitch Medical has developed and obtained FDA approval to market the AMID Hernia Fixation Device (HFD) for both inguinal and ventral hernia repairs. SafeStitch Medical has a couple of people behind it who are also involved in OPKO Health (NYSE: OPK)���a NYSE company with a $2.5 billion market cap. Moreover, these and other insiders were heavy buyers of the stock during the last private placement. On Wednesday, sank 18.57% to $0.855 (SFES has a 52 week trading range of $0.21 to $1.49 a share) for a market cap of $52.75 million but the stock is up 288.6% since the start of the year after surging this summer, up 42.5% over the past year and down 64.4% over the past five years.�

- [By GuruFocus]

Opko Health Inc. (OPK): CEO & Chairman, Director, 10% Owner Phillip Md Et Al Frost Bought 42,700 Shares

CEO & Chairman, Director, 10% Owner of Opko Health, Inc. (OPK) Phillip Md Et Al Frost bought 42,700 shares during the past week at an average price of $10.74. Opko Health, Inc. has a market cap of $4.33 billion; its shares were traded at around $10.74 with and P/S ratio of 39.84.

Top Warren Buffett Stocks To Own Right Now: Tres-Or Resources Ltd. (TRS.V)

Tres-Or Resources Ltd. engages in the acquisition, exploration, and development of gold, diamond, and precious and base metal properties in Quebec and Ontario, Canada. It explores for gold, diamond, platinum/palladium, and precious and base metals. The company focuses on gold exploration in the Abitibi Greenstone Belt of Ontario and Quebec with holdings of approximately 4000 hectares of claims. Tres-Or Resources Ltd. is headquartered in Vancouver, Canada.

Pall Corporation, together with its subsidiaries, manufactures and markets filtration, purification, and separation products and integrated systems solutions worldwide. The company?s Life Sciences segment provides technologies that facilitate the process of drug discovery, development, regulatory validation, and production used in the research laboratories, pharmaceutical and biotechnology industries, food and beverage industry, blood centers, and hospitals at the point of patient care. It also offers medical products that enhance the safety of the use of blood products in patient care and help control the spread of infections in hospitals; and cell therapy products that enable technologies for the regenerative medicine market. In addition, this segment sells various filtration and purification technologies, appurtenant hardware, and engineered systems for the development and commercialization of chemically synthesized and biologically derived drugs, plasma, and vaccines, as well as offers filtration solutions; validation services to drug manufacturers; and laboratory products for use in drug research and discovery, quality control testing, and environmental monitoring applications. Further, it serves the filtration needs of the food and beverage market. The company?s Industrial segment provides enabling and process enhancing technologies for the industrial market. It offers filtration and fluid monitoring equipment to the aerospace industry; filtration and purification technologies for the semiconductor, data storage, fiber optic, advanced display, and materials markets; and a suite of contamination control solutions for chemical, gas, water, chemical mechanical polishing, and photolithography processes. This segment also provides various technologies to producers of energy, oil, gas, renewable and alternative fuels, electricity, chemicals, and municipal water. The company was founded in 1946 and is headquartered in Port Washington, New Yo rk.

Advisors' Opinion: - [By Mike Deane]

On Tuesday, Pall Corp (PLL) announced a 10% raise to its quarterly dividend.

The East Hills, NY-based filtration, purification and separation products supplier will now pay a monthly dividend of 27.5 cents, which is up from its previous quarterly payout of 25 cents. On an annualized basis, PLL will now pay shareholders $1.1 per share.

The dividend is payable on November 8, 2013 to all shareholders on record as of October 18, 2013. The ex-dividend date is October 16, 2013.

PLL shares were down just 5 cents, or .06%, at market close on Tuesday. The company’s stock is up more than 24% YTD.

- [By Benjamin Shepherd]

Pall Corp (NYSE: PLL) is another company that provides water filtration, separation and purification technology, but it tends to focus more on industry users. Just as we all need clean, fresh water to drink, a number of industrial users such as pharmaceutical makers and chip manufacturers require pristine water for their manufacturing processes.

- [By John Divine]

Filtration systems producer Pall (NYSE: PLL ) leads off today's list, having slumped 5.1%. The company reported quarterly results after the markets closed yesterday, and investors were underwhelmed. Sales didn't live up to expectations, although earnings actually beat estimates. The company's outlook really stung shares: Pall said that European expansion was going well, while operations in China were sluggish. Apart from that being the inverse version of what Wall Street wanted to hear, the company also lowered guidance for the fiscal year.

Top Warren Buffett Stocks To Own Right Now: Callidus Software Inc.(CALD)

Callidus Software Inc., together with its subsidiaries, provides sales performance management (SPM) software applications and services. Its products include TrueComp Manager application that automates the modeling, design, administration, reporting, and analysis of pay-for-performance programs; Callidus Reporting for delivering real-time production reports; Callidus Analytics, which enable businesses to deploy performance dashboards across the finance, sales executive, and sales force teams; Callidus Objective Management to design and deploy strategic objective-based bonus plans and long term incentive programs; and Callidus Quota Management to allocate quotas effectively. The company?s products also comprise Callidus Communicator, which accelerates and streamlines communications with a business sales force and sales channels; Callidus Channel Management for telecommunication companies to view and update dealer information; Callidus Producer Management for insurance carri ers; Callidus Onboarding to build and optimize discrete, re-usable workflows; Callidus Coaching to optimize performance of their sales force and call centers; Callidus Plan Communicator that accelerates the process of rolling out and communicating incentive plans across the sales force; Callidus Commissions Manager for sales professionals; and ACom3, an incentive compensation automation suite. In addition, it provides software consulting services, including a range of SPM solution implementations, system upgrades, compensation plan enhancements, migration assistance, reporting and integration consulting, and solution architecture services; and SaaS-based sales assessments, coaching, and talent development solutions. The company serves the telecommunications, insurance, banking, technology, and life sciences/pharmaceuticals markets in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. Callidus Software was founded in 1996 and is headquartered in Pleasanton, California.

Advisors' Opinion: Top Warren Buffett Stocks To Own Right Now: Bravo Brio Restaurant Group Inc.(BBRG)

Bravo Brio Restaurant Group, Inc. owns and operates Italian restaurant brands in the United States. Its brands include BRAVO! Cucina Italiana, and BRIO Tuscan Grille. The company also operates an American-French bistro restaurant under the brand Bon Vie. As of March 02, 2012, it owned and operated 95 restaurants in 30 states. The company was formerly known as Bravo Development, Inc. and changed its name to Bravo Brio Restaurant Group, Inc. in June 2010. Bravo Brio Restaurant Group, Inc. was incorporated in 1987 and is based in Columbus, Ohio.

Advisors' Opinion: - [By CRWE]

Bravo Brio Restaurant Group, Inc. (Nasdaq:BBRG) owner and operator of the BRAVO! Cucina Italiana (BRAVO!) and BRIO Tuscan Grille (BRIO) restaurant concepts, will host a conference call to discuss third quarter 2012 financial results on Tuesday, October 23, 2012 at 5:00 PM ET.

Top Warren Buffett Stocks To Own Right Now: Redwood Trust Inc.(RWT)

Redwood Trust, Inc., a real estate investment trust, together with its subsidiaries, engages in investing, financing, and managing real estate assets. The company?s investments include residential and commercial real estate loans; and securities backed by residential and commercial loans, including senior and subordinate securities. The senior securities are those interests in a securitization that have the first right to cash flows and are last to absorb losses; and subordinate securities are those interests in a securitization that have the last right to cash flows and are first in line to absorb losses. As of March 31, 2011, it had 77 real estate owned properties primarily in Arizona, California, Colorado, Florida, and Georgia. It would elect to be taxed as a real estate investment trust (REIT) for federal income tax purposes. As a REIT, the company would not be subject to federal income tax, if it distributes at least 90% of net taxable income to its stockholders. Red wood Trust, Inc. was founded in 1994 and is based in Mill Valley, California.

Advisors' Opinion: - [By Amanda Alix]

Luxury market is doing just fine

Jumbo loans are back, and these mortgages -- which start at $625,000 in some affluent areas -- are being given out like candy�to those with the wealth to back them up. Once considered risky because they are not backed by Fannie Mae or Freddie Mac, lenders are falling over themselves to make these loans, driven by a securitization market dominated by entities like Redwood Trust (NYSE: RWT ) and JPMorgan Chase (NYSE: JPM ) . Earlier this month, Redwood offered its seventh securitization backed by jumbos, and JPMorgan just recently announced�its second offering of the year, as well.

- [By Amanda Alix]

On the mortgage front, Two Harbors notes that it has acquired a passel of prime jumbo home loans, which it likely plans to securitize. The company's CEO, Tom Siering, also addresses this issue on the earnings call, where he states that the trust was involved in a $400 million securitization of prime jumbo loans. This puts Two Harbors in the company of mREIT Redwood Trust (NYSE: RWT ) , which has nearly single-handedly brought back the jumbo-loan securitization market over the past two years. If Redwood's success is any indication -- it recently reported first-quarter net income�of $61 million, compared to the year-ago figure of $30 million -- Two Harbors is on the right track.

Top Warren Buffett Stocks To Own Right Now: Batm Advanced Communications(BVC.L)

BATM Advanced Communications Ltd. engages in the research, development, production, and marketing of data communication products in the field of local and wide area networks, and premises management systems worldwide. The company offers Ethernet/MPLS aggregation, Ethernet demarcation, multi-service access, fiber-to-the-home and fiber-to-the-business, optical transportation, and wavelength multiplexing products. It also provides TDM products, including multiplexers, SONET products, multi-service IADs, and E/O converters; NMS/EMS products; rugged Ethernet systems; and ATCA hub blades. The company?s data communication products are used by telecommunication carriers and service providers, utilities, municipalities, and government agencies. In addition, the company involves in the research, development, production, marketing, and distribution of medical products, primarily laboratory diagnostic equipment. Further, it offers software services and sterilization products. BATM Ad vanced Communications Ltd. was founded in 1992 and is headquartered in Kfar Netter, Israel.

Top Warren Buffett Stocks To Own Right Now: Pitney Bowes Inc(PBI)

Pitney Bowes Inc. provides mail processing equipment and integrated mail solutions worldwide. It offers a suite of equipment, supplies, software, services, and solutions for managing and integrating physical and digital communication channels. The company?s Small & Medium Business Solutions group engages in the sale, rental, and financing of mail finishing, mail creation, and shipping equipment and software; provision of supply, support, and other professional services; and provision of payment solutions. Its Enterprise Business Solutions group sells, supports, and offers other professional services for high-speed production mail systems, and sorting and production print equipment; and sells and provides support services for non-equipment-based mailing, customer relationship and communication, and location intelligence software. This group also offers facilities management services; secure mail services; reprographic document management services; and litigation support and eDiscovery services, as well as provides presort mail services and cross-border mail services; and direct marketing services. Pitney Bowes Inc. markets its products and services through its sales force, direct mailings, outbound telemarketing, and independent distributors and dealers to various business, governmental, institutional, and other organizations. The company, formerly known as Pitney Bowes Postage Meter Company, was founded in 1920 and headquartered in Stamford, Connecticut.

Advisors' Opinion: - [By Chuck Saletta]

Watch that dividend quality

Similarly, by putting quality controls around a company's dividend and ability to pay it, the iPIG portfolio was able to miss one of the largest recent dividend blow-ups, Pitney Bowes (NYSE: PBI ) . The company slashed its dividend in half last week, but before that cut, it had a 30-year history of regularly raising its dividend.

- [By Sean Williams]

Finally, software and hardware solutions developer for the logistics industry Pitney Bowes (NYSE: PBI ) advanced 3.9% despite no company-specific news. The story here could be more related to short-sellers than anything else. Pitney Bowes is consistently among the S&P 500's most short-sold companies, meaning any slight rally can be exacerbated by short-sellers covering their positions. While today's move certainly gave optimists the upper hand, it does nothing to change the long-term investing thesis that Pitney Bowes' revenue is shrinking, and it's already had to slice its dividend in half to conserve its free cash flow. In my book it's still a stock to steer clear of.

- [By WALLSTCHEATSHEET.COM]

Apparently, the majority of analysts like the stock. That�� surprising. The best chance investors have is that Pitney Bowes continues to cut costs so the stock can stay afloat while large dividends are paid out. However, over the long haul, there is no business without growth.

Reuters

Reuters

Elwyn (right), however, sees things differently. “Despite the extremes of market highs and lows, what’s consistent is that many competitors – at the wirehouse and regional firms – continue to create pain points for their advisors,” he said.

Elwyn (right), however, sees things differently. “Despite the extremes of market highs and lows, what’s consistent is that many competitors – at the wirehouse and regional firms – continue to create pain points for their advisors,” he said. ValuationShares of Kraton currently trade around 12x 12-month forward earnings, which might sound cheap on an absolute basis, but is a premium to both the industry mu! ltiple and its historical median. Its price to cash flow ratio of 18 is also above the industry and its historical median.The Bottom LineWith falling earnings estimates and premium valuation, investors should consider avoiding this Zacks Rank #5 (Strong Sell) stock until its earnings momentum turns around.Todd Bunton is the Growth & Income Stock Strategist for Zacks Investment Research and Editor of the Income Plus Investor service.

ValuationShares of Kraton currently trade around 12x 12-month forward earnings, which might sound cheap on an absolute basis, but is a premium to both the industry mu! ltiple and its historical median. Its price to cash flow ratio of 18 is also above the industry and its historical median.The Bottom LineWith falling earnings estimates and premium valuation, investors should consider avoiding this Zacks Rank #5 (Strong Sell) stock until its earnings momentum turns around.Todd Bunton is the Growth & Income Stock Strategist for Zacks Investment Research and Editor of the Income Plus Investor service.

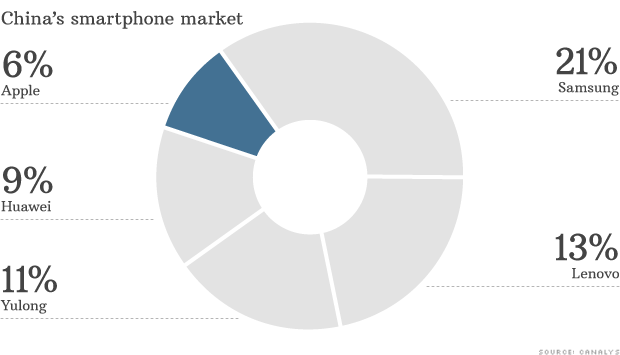

NEW YORK (CNNMoney) Apple's landmark deal with China Mobile gives it access to more than 700 million new cell phone customers -- a staggering number. But it still has a long way to go before it's a power player in the world's biggest market for smartphones.

NEW YORK (CNNMoney) Apple's landmark deal with China Mobile gives it access to more than 700 million new cell phone customers -- a staggering number. But it still has a long way to go before it's a power player in the world's biggest market for smartphones.  Will the iPhone succeed in China?

Will the iPhone succeed in China?

Popular Posts: Take Your Profits Now: 5 Energy Stocks To Trim in 20145 REIT ETFs to Buy Now for Big Income3 Stocks to Power Your Portfolio With Canadian Oil Sands Recent Posts: The 3 Best Coal Stocks to Buy Now BP Scores a Hat Trick of Deals and Discoveries XOM and SLB – Your Best Ways to Play a Mexico Oil Boom View All Posts

Popular Posts: Take Your Profits Now: 5 Energy Stocks To Trim in 20145 REIT ETFs to Buy Now for Big Income3 Stocks to Power Your Portfolio With Canadian Oil Sands Recent Posts: The 3 Best Coal Stocks to Buy Now BP Scores a Hat Trick of Deals and Discoveries XOM and SLB – Your Best Ways to Play a Mexico Oil Boom View All Posts  Coal stocks have faced the dual threat of falling demand coupled with rising regulation. First, our abundance of natural gas — which has been great for the oil stocks — has pushed prices down for the fuel towards historic lows. That's causing utilities to abandon coal in favor of cheap natural gas for electricity generation.

Coal stocks have faced the dual threat of falling demand coupled with rising regulation. First, our abundance of natural gas — which has been great for the oil stocks — has pushed prices down for the fuel towards historic lows. That's causing utilities to abandon coal in favor of cheap natural gas for electricity generation. When it comes to coal stocks, Peabody Energy (BTU) is definitely king of them all.

When it comes to coal stocks, Peabody Energy (BTU) is definitely king of them all. For coal stocks, Wyoming's Powder River Basin features some of the best coal reserves on the planet. Aside from the sheer amount of coal, it has some of the lowest sulfur-producing reserves. That makes it ideal for utilities trying to skirt new EPA rules about emissions.

For coal stocks, Wyoming's Powder River Basin features some of the best coal reserves on the planet. Aside from the sheer amount of coal, it has some of the lowest sulfur-producing reserves. That makes it ideal for utilities trying to skirt new EPA rules about emissions. With the global economy finally beginning to move forward, Alpha Natural Resources (ANR) is one of a few coals stocks that could be an interesting turnaround play. See, unlike CLD and BTU, ANR mainly produces metallurgical coal — the kind used in steel making.

With the global economy finally beginning to move forward, Alpha Natural Resources (ANR) is one of a few coals stocks that could be an interesting turnaround play. See, unlike CLD and BTU, ANR mainly produces metallurgical coal — the kind used in steel making. It starts: Fed chairman Ben S. Bernanke has started the taper. Bloomberg News

It starts: Fed chairman Ben S. Bernanke has started the taper. Bloomberg News

Getty Images/Blend Images RM A major in theater often sits atop lists of the most useless college degrees, but by studying theater as an undergrad, I actually think I learned how to bootstrap my business. (I also went to a state college, so it was an affordable theater degree. Shout out to Minnesota State University - Mankato!) Here's a list of the valuable skills I acquired there that I've taken to heart over the last 10 years, and how they affect my business today. 1. Show Up In theater, if you don't audition, you won't get cast. You have to put yourself out there. Nowadays, I email people I don't know. I didn't know that this was weird. I've always reached out to people whose work I admire. I email people every week, and I don't expect anything in return. Sometimes I get an email back; sometimes I don't. But that's OK, because I just wanted to let that person know how his or her work has affected me. In theater, you audition for show after show after show, and you rarely get cast -- but if you don't put yourself out there, you'll never get cast. People ask how I've managed to get so much press in the past year; the answer simple: I'm not afraid to put myself out there. 2. Connect With People Immediately Theater always attracts the most interesting characters, and you learn to accept people for their uniqueness. You also learn how to get along with people who drive you nuts. More importantly, theater taught me how to connect with people instantly. I love finding out what others are interested in and connecting them with others who share their interests. I learned (just a few years ago) that this is called "networking." I thought everyone did this!

Getty Images/Blend Images RM A major in theater often sits atop lists of the most useless college degrees, but by studying theater as an undergrad, I actually think I learned how to bootstrap my business. (I also went to a state college, so it was an affordable theater degree. Shout out to Minnesota State University - Mankato!) Here's a list of the valuable skills I acquired there that I've taken to heart over the last 10 years, and how they affect my business today. 1. Show Up In theater, if you don't audition, you won't get cast. You have to put yourself out there. Nowadays, I email people I don't know. I didn't know that this was weird. I've always reached out to people whose work I admire. I email people every week, and I don't expect anything in return. Sometimes I get an email back; sometimes I don't. But that's OK, because I just wanted to let that person know how his or her work has affected me. In theater, you audition for show after show after show, and you rarely get cast -- but if you don't put yourself out there, you'll never get cast. People ask how I've managed to get so much press in the past year; the answer simple: I'm not afraid to put myself out there. 2. Connect With People Immediately Theater always attracts the most interesting characters, and you learn to accept people for their uniqueness. You also learn how to get along with people who drive you nuts. More importantly, theater taught me how to connect with people instantly. I love finding out what others are interested in and connecting them with others who share their interests. I learned (just a few years ago) that this is called "networking." I thought everyone did this!