Wake up calls are never pleasant, but this one was particularly harsh: Over the course of just nine trading days in late January and early February, U.S. stocks dropped 10% as investors fretted over a government report showing higher than expected wage inflation. The plunge wiped out stock market gains for the year and chalked up one of the swiftest corrections in recent decades.

Investors tried to settle back into the dream world that dominated recent years, where stocks kept hitting new highs, volatility was at record lows and there was barely a hint of inflation. But the alarm bells kept ringing. In late March, fears of a trade war between the U.S. and China sent stocks skidding again. And while stocks plunged, the bonds that form the core of many retirees�� portfolios didn��t live up to their safe-haven reputation. The Bloomberg Barclays U.S. Aggregate Bond index fell sharply during the stock market downturn and ended the first quarter down 1.5%.

Top China Stocks To Invest In 2019: Sina Corporation(SINA)

Advisors' Opinion:- [By Jack Delaney]

SINA Corp. (Nasdaq: SINA) operates Weibo Corp. (Nasdaq: WB), a social media platform with 411 million monthly active users (MAUs) as of Q1 2018.

It's considered the Twitter Inc. (NYSE: TWTR) of China.

- [By Ethan Ryder]

Eagle Global Advisors LLC decreased its position in Sina Corp (NASDAQ:SINA) by 1.8% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 84,875 shares of the technology company’s stock after selling 1,595 shares during the period. Eagle Global Advisors LLC owned about 0.12% of Sina worth $8,850,000 at the end of the most recent quarter.

- [By Shane Hupp]

SINA Corp (NASDAQ:SINA) shares hit a new 52-week low on Wednesday . The stock traded as low as $83.39 and last traded at $82.78, with a volume of 41597 shares trading hands. The stock had previously closed at $85.15.

- [By Leo Sun]

JD.com (NASDAQ:JD) recently partnered with SINA (NASDAQ:SINA), one of China's top portal sites, to pool the two companies' user data and resources together. JD.com will help SINA optimize its algorithms to match its readers with�more relevant content -- which could help its portal sites lock in more users.

- [By Leo Sun]

Shares of SINA (NASDAQ:SINA) and Weibo (NASDAQ:WB) have both tumbled this year, mainly due to escalating trade tensions between the United States and China. Yet their sell-offs seem overdone, since both tech companies are well insulated from a potential trade war.

Top China Stocks To Invest In 2019: Renesola Ltd.(SOL)

Advisors' Opinion:- [By Joseph Griffin]

These are some of the media headlines that may have impacted Accern’s scoring:

Get ReneSola alerts: ReneSola Sells North Carolina Solar Project To Greenbacker (solarindustrymag.com) ReneSola (SOL) Rating Increased to Neutral at Roth Capital (americanbankingnews.com) ReneSola (SOL) Q1 Earnings in Line, Revenues Top Estimates (zacks.com) ReneSola’s (SOL) CEO Xianshou Li on Q1 2018 Results – Earnings Call Transcript (seekingalpha.com) ReneSola (SOL) Releases Earnings Results (americanbankingnews.com)Shares of ReneSola traded up $0.08, hitting $2.76, during trading on Friday, Marketbeat.com reports. The stock had a trading volume of 124,969 shares, compared to its average volume of 108,565. The firm has a market capitalization of $102.11 million, a PE ratio of 21.23 and a beta of 2.05. The company has a current ratio of 1.17, a quick ratio of 1.17 and a debt-to-equity ratio of 0.36. ReneSola has a 12 month low of $2.12 and a 12 month high of $3.79.

Top China Stocks To Invest In 2019: Netease.com Inc.(NTES)

Advisors' Opinion:- [By Max Byerly]

KAMES CAPITAL plc decreased its holdings in shares of NetEase (NASDAQ:NTES) by 68.8% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 17,800 shares of the technology company’s stock after selling 39,277 shares during the period. KAMES CAPITAL plc’s holdings in NetEase were worth $4,991,000 at the end of the most recent reporting period.

- [By Shane Hupp]

These are some of the news headlines that may have effected Accern’s rankings:

Get NetEase alerts: Study Stock Price Behavior with Financial Report for NetEase, Inc. (NTES) (finherald.com) Analysis of Analyst Stock Recommendation: NetEase, Inc. (NTES) (nasdaqplace.com) Notable Moving Tech Stock: NetEase, Inc. (NTES) (nasdaqplace.com) Investors must not feel shy to buy these Stocks: NetEase, Inc. (NASDAQ:NTES), YUM! Brands, Inc. (NYSE:YUM), Erie … (journalfinance.net) Destiny maker Bungie raises $100M from China��s NetEase to build new games (geekwire.com)NetEase traded up $3.95, hitting $243.58, during midday trading on Friday, MarketBeat.com reports. The stock had a trading volume of 1,182,914 shares, compared to its average volume of 1,423,698. The firm has a market cap of $31.99 billion, a price-to-earnings ratio of 19.63, a PEG ratio of 1.83 and a beta of 0.82. NetEase has a 1-year low of $222.32 and a 1-year high of $377.64.

- [By Ethan Ryder]

Here are some of the news stories that may have effected Accern Sentiment’s rankings:

Get NetEase alerts: NetEase Inc (NTES) Receives Average Rating of “Hold” from Analysts (americanbankingnews.com) NetEase Inc (NTES) Sees Significant Growth in Short Interest (americanbankingnews.com) Hot Stock’s Trend Recap �� NetEase Inc (NASDAQ: NTES) (stockspen.com) Switching Three Stocks: The Procter & Gamble Company (NYSE:PG), NetEase, Inc. (NASDAQ:NTES), CBRE Group … (thestreetpoint.com) US benchmarks shake off G7 jitters, ending the day on a positive note (proactiveinvestors.co.uk)A number of equities research analysts have issued reports on the stock. BidaskClub lowered shares of NetEase from a “hold” rating to a “sell” rating in a report on Tuesday, March 27th. Jefferies Financial Group cut their price target on shares of NetEase from $335.00 to $310.00 and set a “hold” rating on the stock in a report on Tuesday, April 10th. JPMorgan Chase & Co. assumed coverage on shares of NetEase in a report on Thursday, April 12th. They issued an “underweight” rating and a $240.00 price target on the stock. Zacks Investment Research raised shares of NetEase from a “sell” rating to a “hold” rating in a report on Thursday, March 8th. Finally, Daiwa Capital Markets raised shares of NetEase from a “neutral” rating to a “buy” rating in a report on Thursday, May 17th. Four research analysts have rated the stock with a sell rating, four have given a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the stock. The company has a consensus rating of “Hold” and a consensus target price of $327.21.

- [By WWW.GURUFOCUS.COM]

For the details of Overlook Holdings Ltd's stock buys and sells, go to http://www.gurufocus.com/StockBuy.php?GuruName=Overlook+Holdings+Ltd

These are the top 5 holdings of Overlook Holdings LtdNetEase Inc (NTES) - 756,622 shares, 58.02% of the total portfolio. Shares reduced by 15.29%Baidu Inc (BIDU) - 569,283 shares, 41.98% of the total portfolio. - [By ]

NetEase Inc (NYSE: NTES) is the largest online services provider in China with revenue from its e-commerce platform and online gaming. Sales on its e-commerce platform surged 157% last year to support slower growth in gaming which accounts for about 75% of total revenue. The company is also starting to monetize its gaming segment with movies and mini-series based on the characters in the games.

Top China Stocks To Invest In 2019: Focus Media Holding Limited(FMCN)

Advisors' Opinion:- [By Stephan Byrd]

An issue of Focus Media Holding Limited (NASDAQ:FMCN) bonds fell 0.9% against their face value during trading on Monday. The high-yield debt issue has a 7.25% coupon and will mature on April 1, 2023. The bonds in the issue are now trading at $99.13 and were trading at $98.13 last week. Price moves in a company’s bonds in credit markets sometimes anticipate parallel moves in its share price.

- [By Stephan Byrd]

An issue of Focus Media Holding Limited (NASDAQ:FMCN) debt fell 1.1% against its face value during trading on Tuesday. The debt issue has a 7.5% coupon and is set to mature on April 1, 2025. The debt is now trading at $97.63 and was trading at $98.50 last week. Price changes in a company’s debt in credit markets sometimes anticipate parallel changes in its stock price.

Top China Stocks To Invest In 2019: Top Image Systems Ltd.(TISA)

Advisors' Opinion:- [By Ethan Ryder]

Get a free copy of the Zacks research report on Top Image Systems (TISA)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Top China Stocks To Invest In 2019: Baidu Inc.(BIDU)

Advisors' Opinion:- [By Leo Sun]

Baidu's (NASDAQ:BIDU) video streaming unit�iQiyi (NASDAQ:IQ) recently unveiled a VR headset called the Qiyu VR II. The device, which was built via a collaboration with Qualcomm, plays 4K videos as well as 8K panoramic videos.

- [By Leo Sun]

Baidu (NASDAQ:BIDU) and China Mobile (NYSE:CHL) recently signed a sweeping strategic partnership that pools their resources in "frontier areas" including AI, big data, 5G networks, and driverless cars. China Mobile, the largest wireless carrier in China, will also offer exclusive discounted data plans for 13 Baidu products, including Baidu's core app, its iQiyi�video streaming platform, and its Reddit-like PostBar social media network.

- [By Leo Sun]

Baidu (NASDAQ:BIDU), Alibaba (NYSE:BABA), and Tencent (NASDAQOTH:TCEHY) are considered fierce rivals in China's tech market. Baidu owns the country's top search engine, Alibaba's owns its biggest e-commerce marketplace, while Tencent dominates the social media and video gaming markets.

- [By Shane Hupp]

Caisse DE Depot ET Placement DU Quebec lowered its position in Baidu Inc (NASDAQ:BIDU) by 23.0% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 286,718 shares of the information services provider’s stock after selling 85,750 shares during the period. Caisse DE Depot ET Placement DU Quebec owned approximately 0.08% of Baidu worth $63,993,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

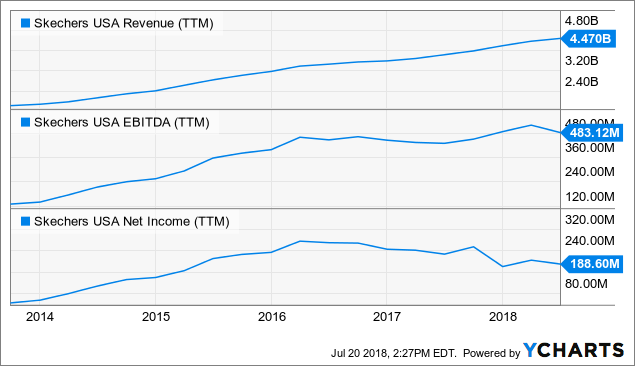

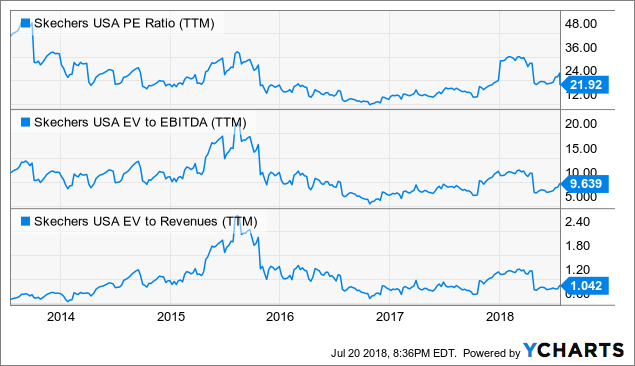

SKX Revenue (TTM) data by YCharts

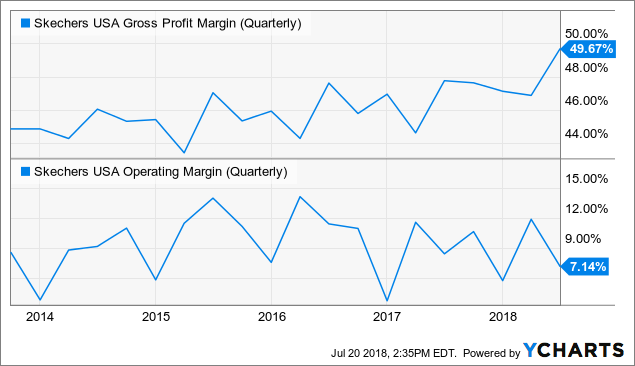

SKX Revenue (TTM) data by YCharts SKX Gross Profit Margin (Quarterly) data by YCharts

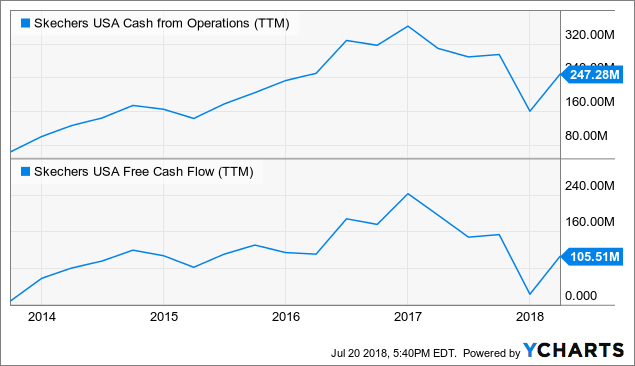

SKX Gross Profit Margin (Quarterly) data by YCharts SKX Cash from Operations (TTM) data by YCharts

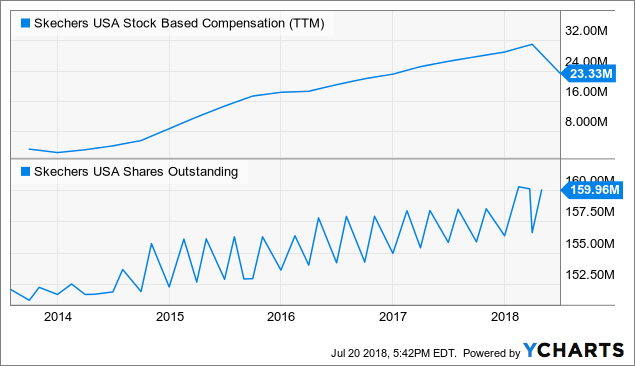

SKX Cash from Operations (TTM) data by YCharts SKX Stock Based Compensation (TTM) data by YCharts

SKX Stock Based Compensation (TTM) data by YCharts SKX PE Ratio (TTM) data by YCharts

SKX PE Ratio (TTM) data by YCharts BidaskClub upgraded shares of Capital City Bank Group (NASDAQ:CCBG) from a hold rating to a buy rating in a report published on Friday.

BidaskClub upgraded shares of Capital City Bank Group (NASDAQ:CCBG) from a hold rating to a buy rating in a report published on Friday.