Exxon Mobil Co. (NYSE:XOM) – Investment analysts at Jefferies Financial Group issued their Q3 2018 EPS estimates for Exxon Mobil in a report issued on Monday, July 30th. Jefferies Financial Group analyst J. Gammel anticipates that the oil and gas company will earn $1.53 per share for the quarter. Jefferies Financial Group currently has a “Neutral” rating and a $87.00 target price on the stock. Jefferies Financial Group also issued estimates for Exxon Mobil’s Q4 2018 earnings at $1.64 EPS.

Get Exxon Mobil alerts:Exxon Mobil (NYSE:XOM) last announced its quarterly earnings data on Friday, July 27th. The oil and gas company reported $0.92 EPS for the quarter, missing the Zacks’ consensus estimate of $1.26 by ($0.34). Exxon Mobil had a return on equity of 8.45% and a net margin of 7.64%. The business had revenue of $73.50 billion for the quarter, compared to analyst estimates of $71.66 billion. During the same quarter in the previous year, the business posted $0.78 earnings per share. The company’s revenue was up 26.6% compared to the same quarter last year.

Several other equities research analysts have also issued reports on XOM. JPMorgan Chase & Co. reiterated a “neutral” rating and set a $88.00 price target on shares of Exxon Mobil in a report on Tuesday, July 10th. Macquarie reiterated a “sell” rating and set a $70.00 price target on shares of Exxon Mobil in a report on Tuesday, July 10th. Barclays reiterated a “sell” rating and set a $84.00 price target on shares of Exxon Mobil in a report on Tuesday, July 10th. Morningstar set a $85.00 price target on Exxon Mobil and gave the company a “neutral” rating in a report on Monday, June 11th. Finally, HSBC reiterated a “buy” rating and set a $93.50 price target on shares of Exxon Mobil in a report on Monday, July 16th. Five research analysts have rated the stock with a sell rating, fifteen have issued a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. The company presently has an average rating of “Hold” and a consensus price target of $86.98.

Shares of Exxon Mobil opened at $80.39 on Thursday, according to MarketBeat. Exxon Mobil has a one year low of $72.15 and a one year high of $89.30. The stock has a market cap of $346.37 billion, a price-to-earnings ratio of 22.39, a price-to-earnings-growth ratio of 1.22 and a beta of 0.92. The company has a debt-to-equity ratio of 0.11, a current ratio of 0.80 and a quick ratio of 0.50.

Hedge funds have recently modified their holdings of the stock. Integrated Investment Consultants LLC increased its position in Exxon Mobil by 281.4% in the 2nd quarter. Integrated Investment Consultants LLC now owns 105,845 shares of the oil and gas company’s stock worth $2,377,000 after buying an additional 78,092 shares during the period. Cooke & Bieler LP increased its position in Exxon Mobil by 1.2% in the 2nd quarter. Cooke & Bieler LP now owns 1,276,587 shares of the oil and gas company’s stock worth $105,612,000 after buying an additional 15,548 shares during the period. Capital Investment Advisory Services LLC increased its position in Exxon Mobil by 6.3% in the 2nd quarter. Capital Investment Advisory Services LLC now owns 26,066 shares of the oil and gas company’s stock worth $2,156,000 after buying an additional 1,540 shares during the period. Wagner Wealth Management LLC increased its position in Exxon Mobil by 18.3% in the 2nd quarter. Wagner Wealth Management LLC now owns 14,895 shares of the oil and gas company’s stock worth $1,232,000 after buying an additional 2,309 shares during the period. Finally, Joel Isaacson & Co. LLC increased its position in Exxon Mobil by 4.3% in the 2nd quarter. Joel Isaacson & Co. LLC now owns 44,434 shares of the oil and gas company’s stock worth $3,676,000 after buying an additional 1,838 shares during the period. 51.96% of the stock is currently owned by institutional investors and hedge funds.

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 10th. Investors of record on Monday, August 13th will be paid a $0.82 dividend. This represents a $3.28 dividend on an annualized basis and a dividend yield of 4.08%. The ex-dividend date is Friday, August 10th. Exxon Mobil’s payout ratio is 91.36%.

Exxon Mobil Company Profile

Exxon Mobil Corporation explores for and produces crude oil and natural gas in the United States, Canada/Other Americas, Europe, Africa, Asia, and Australia/Oceania. It operates through Upstream, Downstream, and Chemical segments. The company also manufactures petroleum products; manufactures and markets commodity petrochemicals, including olefins, aromatics, polyethylene, and polypropylene plastics, as well as various specialty products; and transports and sells crude oil, natural gas, and petroleum products.

See Also: Price to Earnings Ratio (PE) Basics

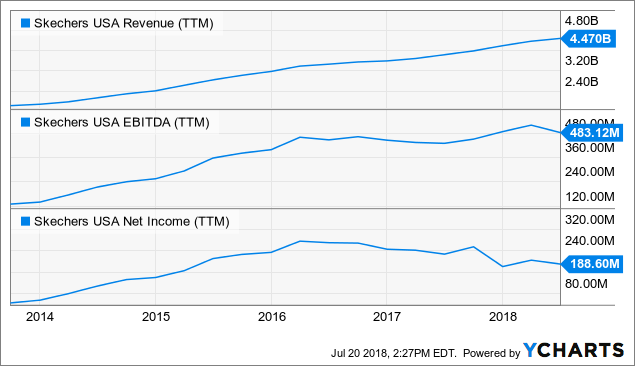

SKX Revenue (TTM) data by YCharts

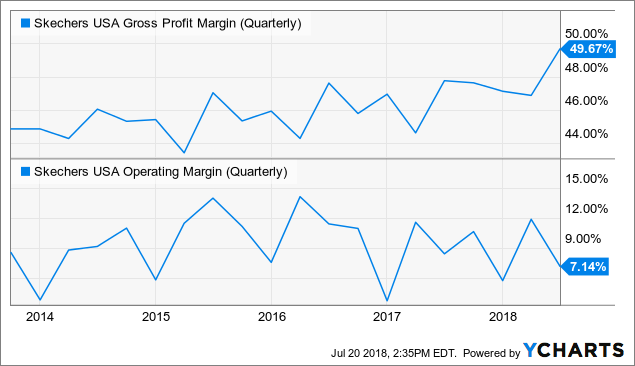

SKX Revenue (TTM) data by YCharts SKX Gross Profit Margin (Quarterly) data by YCharts

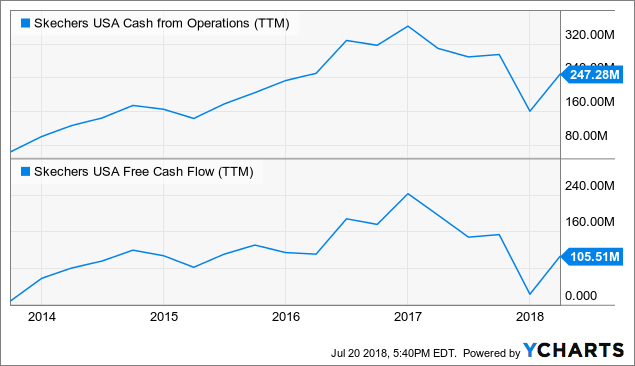

SKX Gross Profit Margin (Quarterly) data by YCharts SKX Cash from Operations (TTM) data by YCharts

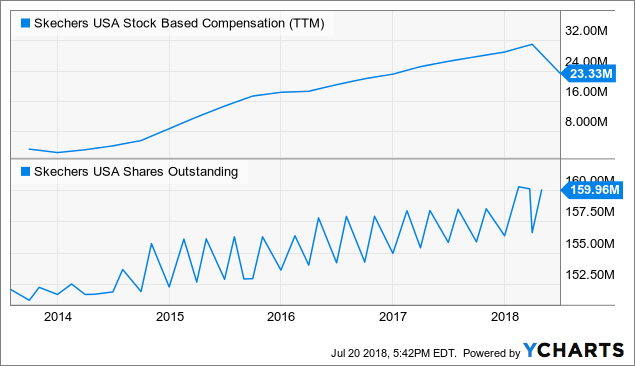

SKX Cash from Operations (TTM) data by YCharts SKX Stock Based Compensation (TTM) data by YCharts

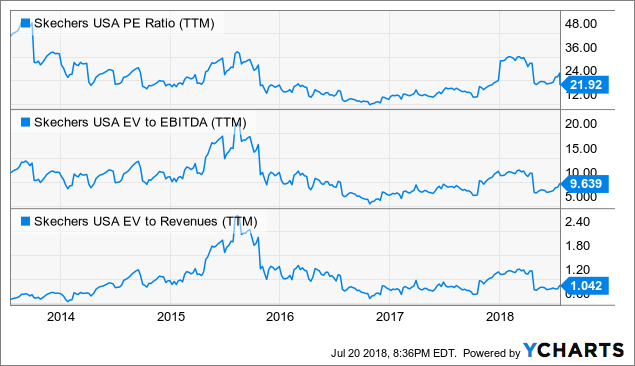

SKX Stock Based Compensation (TTM) data by YCharts SKX PE Ratio (TTM) data by YCharts

SKX PE Ratio (TTM) data by YCharts BidaskClub upgraded shares of Capital City Bank Group (NASDAQ:CCBG) from a hold rating to a buy rating in a report published on Friday.

BidaskClub upgraded shares of Capital City Bank Group (NASDAQ:CCBG) from a hold rating to a buy rating in a report published on Friday. Analysts predict that Tetra Tech, Inc. (NASDAQ:TTEK) will post $541.79 million in sales for the current quarter, Zacks reports. Five analysts have issued estimates for Tetra Tech’s earnings. The lowest sales estimate is $538.54 million and the highest is $545.00 million. Tetra Tech reported sales of $498.48 million during the same quarter last year, which would indicate a positive year-over-year growth rate of 8.7%. The business is scheduled to issue its next earnings report on Wednesday, August 1st.

Analysts predict that Tetra Tech, Inc. (NASDAQ:TTEK) will post $541.79 million in sales for the current quarter, Zacks reports. Five analysts have issued estimates for Tetra Tech’s earnings. The lowest sales estimate is $538.54 million and the highest is $545.00 million. Tetra Tech reported sales of $498.48 million during the same quarter last year, which would indicate a positive year-over-year growth rate of 8.7%. The business is scheduled to issue its next earnings report on Wednesday, August 1st.